The Vest U.S. Large Cap 20% Buffer Strategies VI Fund (the “Fund”) seeks capital appreciation. The Fund is designed to cushion against (or “buffer”) equity losses in down markets, while taking advantage of growth opportunities in up markets.

The Fund invests in a laddered portfolio of a disciplined options strategy, called the “Buffer Strategy.” The goal of each Buffer Strategy is:

Protect 20% of Downside Losses

Seeks to buffer the first 20% of losses in U.S. large-cap equities.

Participate in Upside Performance

Seeks to capture potential growth in U.S. large-cap equities, to a maximum gain.

“Vest’s Buffer Strategy, introduced in 2016, is now available as an investment within select insurance or annuity products.”

Why Invest in This Fund

Equities offer promising growth potential for investments, but equities can be severely affected by events that are difficult to predict. Losses can have a greater impact on investments than gains, because the money left after the loss has to work harder just to get back to the original levels.

The Fund offers an innovative approach that seeks to strike the right balance: aiming to provide a persistent cushion against potential equity losses while allowing investors to participate in some of the potential growth opportunities that equities provide.

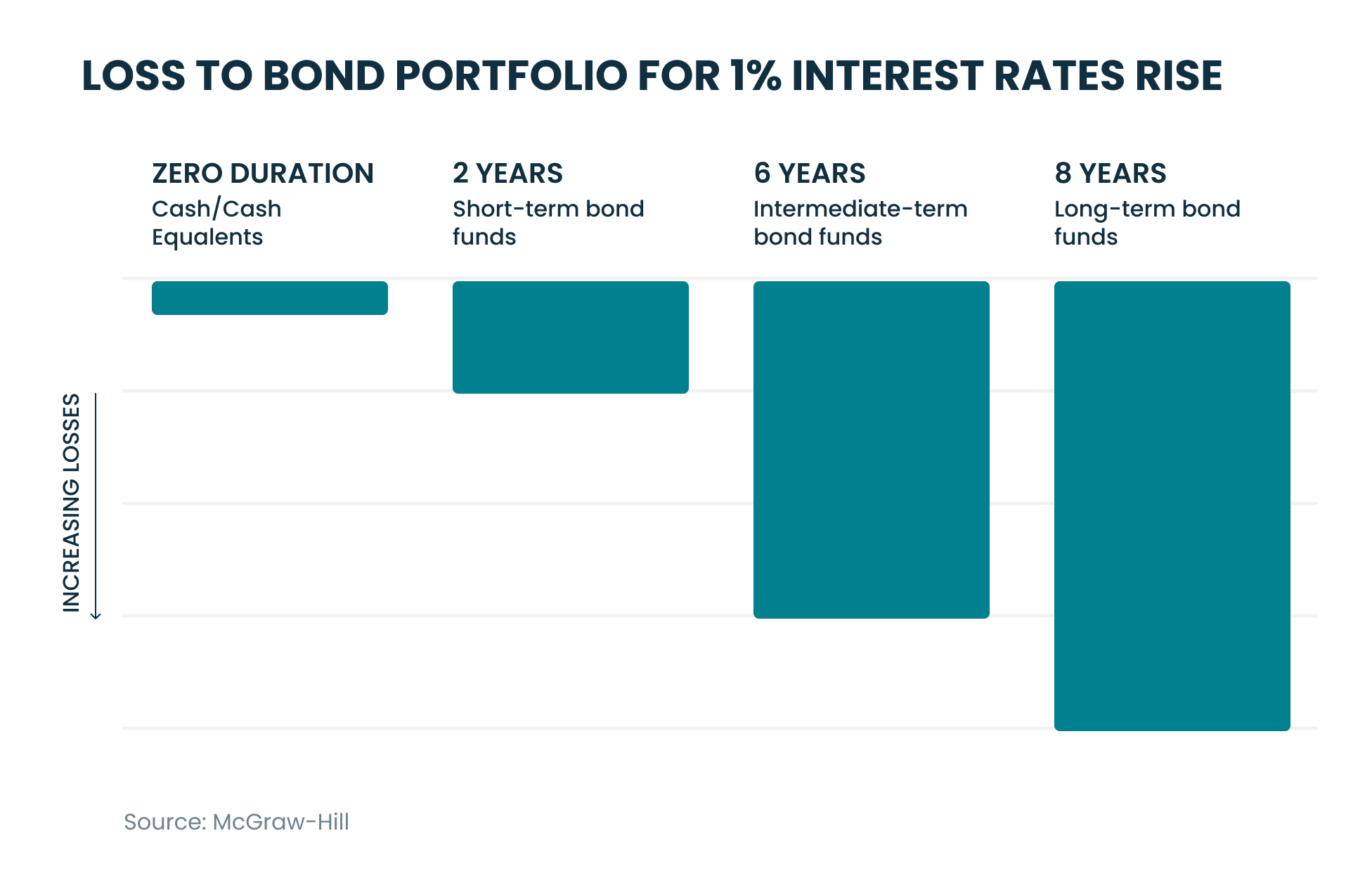

Traditionally, investors have relied on diversifying equities with bonds, or market timing, to help minimize their risks from losses. But these strategies may be challenged in certain market environments.

- 60/40 may not be the answer

Many investors maintain an allocation to fixed income investments to provide a counterbalance to equities during times of market volatility. However, bonds may decline at the same time as equities, negating the expected counterbalance benefit. Fixed income may also be challenged when interest rates rise, and lose purchasing power in an inflationary environment. - Being cautious does not mean being in cash

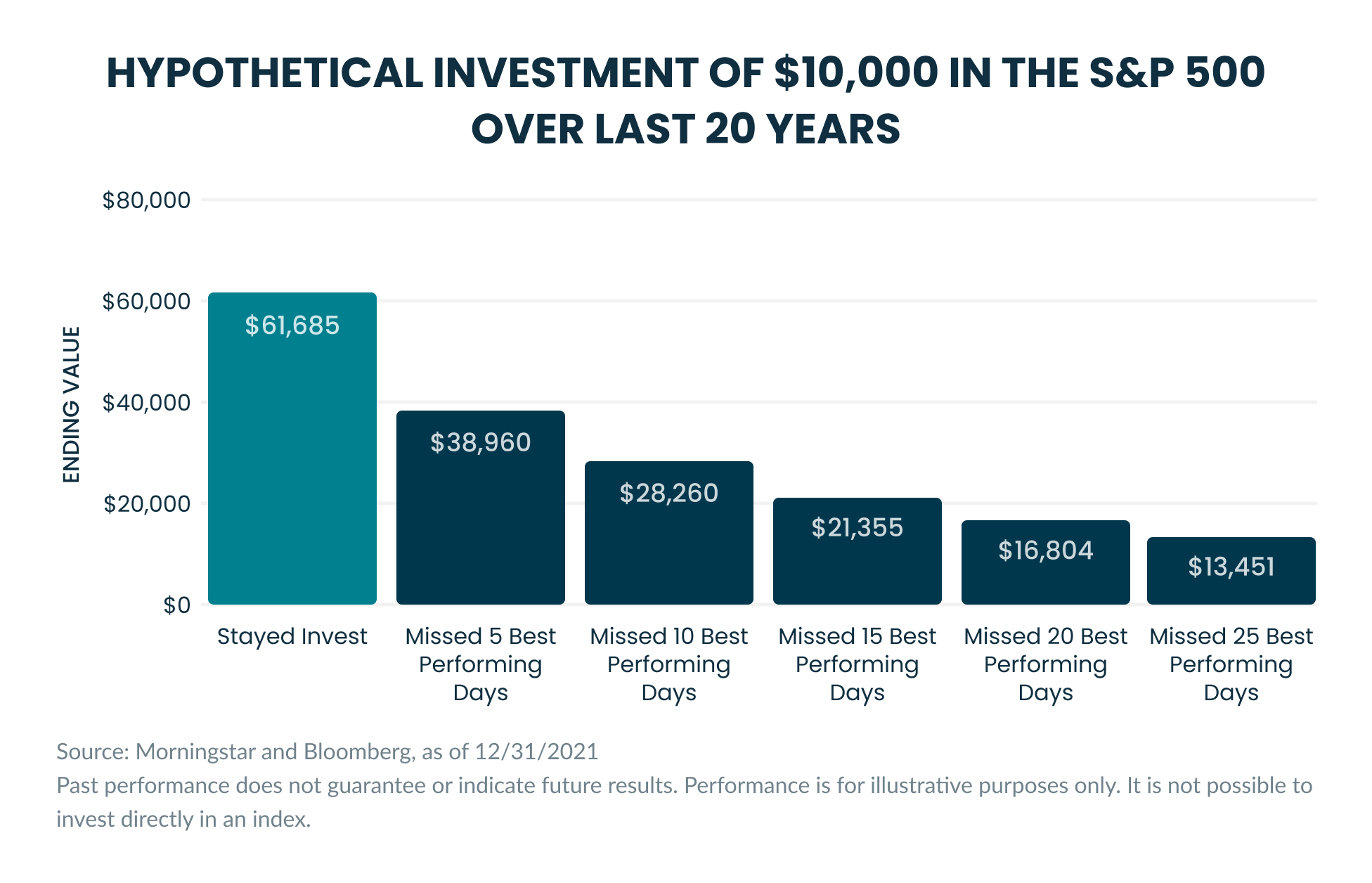

Investors who sell at the first sign of market downturns and wait on the sidelines in cash for the market to recover can miss out on top-performing days, which can have a big impact on returns.

When will the next pullback occur, or when will interest rates or inflation rise? While it’s not possible to predict the future, it is important to prepare for it. The Fund offers a new approach that may help cushion an investment against losses through the use of options—instruments that seek to offer a contractual level of certainty that other approaches lack. To understand the contractual nature of options and why it matters, click here.

Some structured notes and variable annuities provide targeted outcomes like the Buffer Strategy but may come with unique risks, including concentrated credit risks, lack of transparency and lack of liquidity. For a comparison of these investment products, click here. The Fund offers access to the Buffer Strategy in a potentially more transparent, more liquid and more familiar investment vehicle of a fund registered under the Investment Company Act of 1940. In addition, investing in a Buffer Strategy with a single maturity as is commonly done in structured notes or annuities comes with acute timing risks. The Fund follows a laddered portfolio approach, in an attempt to manage these timing risks. To better understand these timing risks, click here.

How It Works

The Fund seeks to meet its objective by providing investors with U.S. large-cap equity market exposure while attempting to limit downside risk through a laddered portfolio of twelve 20% buffer strategies (each a “20% Buffer Strategy”) by constructing a portfolio of options linked to a U.S. large-cap equity index (the “Index”) such as the S&P 500 Index.

The 20% Buffer Strategy is an option strategy designed to cushion against or “buffer” the first 20% drop in a U.S. large-cap equity index over a period of approximately one year, while still providing the opportunity for growth from appreciation in the reference asset to a maximum predetermined cap level (“cap”). While the Advisor seeks to deliver the returns for each of the twelve 20% Buffer Strategies in the laddered portfolio, the strategy may not work as intended. The protection intended by the strategy is not guaranteed and it is possible to lose more than the targeted 20% buffer.

The cap level is set at the start of the one-year period, such that giving up potential returns above the cap pays for the 20% buffer. The returns of the strategy will be a function of the level of the index at the end of the period relative to its level at the start of the period, as detailed in the illustration below. The value of Fund shares may be influenced by multiple factors other than the performance of the index. This includes, but is not limited to, the volatility of the index, the dividend rate on the index, and the level of interest rates.

If the price of Index appreciates more than the cap level:

The 20% Buffer Strategy seeks to provide a total return that equals the predetermined cap level.

If the price of the Index appreciates, but less than the cap level:

The 20% Buffer Strategy seeks to provide a total return that increases by the percentage increase of the Index, up to the predetermined cap level.

If the price of the Index decreases by 20% or less:

The 20% Buffer Strategy seeks to provide a total return of zero.

If the price of the Index decreases by more than 20%:

The 20% Buffer Strategy seeks to provide a total return loss that is 20% less than the percentage decrease in the price of the Index with a maximum loss of approximately 80%.

Investing in a Buffer Strategy with a single maturity as is commonly done in structured notes or annuities comes with acute timing risks. To better understand these timing risks, click here.

The Fund invests in a laddered portfolio of 12 Buffer Strategies with maturities varying from one to 12 months. Each month, a Buffer Strategy matures and is rolled forward for another 12 months. This allows the buffer and cap levels to reset and stay current to the prevailing market conditions for a portion of the Fund's investment.

Learn more about laddering

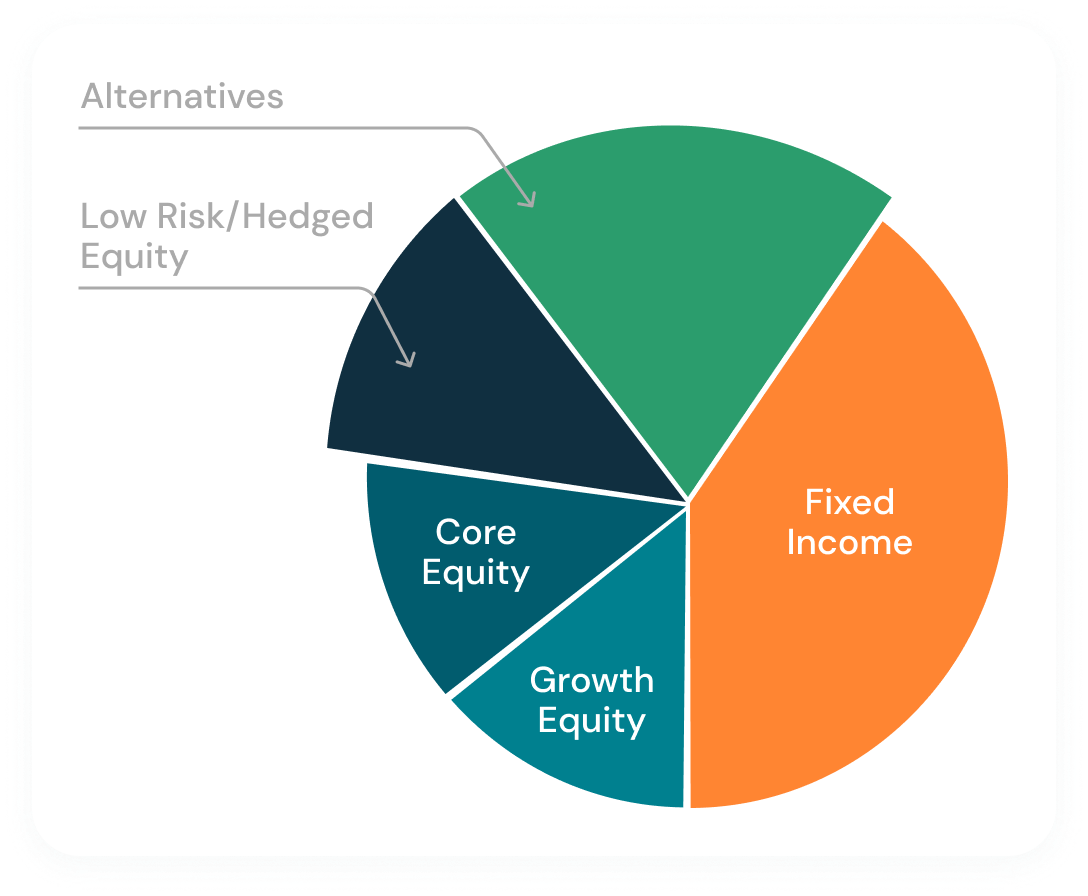

Where It Fits in the Portfolio

The Fund can fit in two places in an investor’s portfolio:

- Low Risk/Hedged Equity A common way to reduce downside risk is to reduce allocation to equities. However, this creates the risk of missing out on potential upside. The Fund offers an alternative approach that seeks to deliver some benefits of upside from equities with reduced downside risk, allowing investors to stay persistently invested.

- Alternatives

The Fund’s risk/return characteristics provide lower downside risks through capping some upside, similar to alternative investments such as hedged funds. As a result, the Fund may be used as a potentially cost-competitive alternative to hedge funds.

Additional Resources & FAQs

Fund Facts & Stats

Contact Us

Important Disclosures, Please Read

Investors should consider the investment objectives, potential risks, management fees and charges and expenses carefully before investing. This and other information is contained in the Fund’s prospectus, which may be obtained online, or by calling 855-505-VEST (8378). Please read the prospectus carefully before investing. Distributed by Foreside Fund Services, LLC, Portland, ME. Member FINRA/SIPC.

View this firm's background on FINRA's BrokerCheck.

On January 2, 2024, the Fund’s name changed from Cboe Vest U.S. Large Cap 20% Buffer Strategies VI Fund to Vest U.S. Large Cap 20% Buffer Strategies VI Fund. This is a change in name only; the Fund’s objective and principal investment strategy remain the same.

Any comments or statements made herein do not reflect the views of Vest Group Inc. or any of their subsidiaries or affiliates.

Risk Factors

Investing involves risk. Loss of principal is possible. While the Advisor seeks to deliver the returns of the 20% Buffer Strategy for each of the 12 strategies in the laddered portfolio, the strategy may not work as intended. The protection intended by the strategy is not guaranteed, and it is possible to lose more than the targeted 20% buffer. The Fund’s investment strategy is not designed to achieve a specific outcome over a specific holding period.

Derivative Securities Risk. The Fund may invest in derivative securities. The Fund could experience a loss if derivatives do not perform as anticipated, or are not correlated with the performance of other investments which are used to hedge, or if the Fund is unable to liquidate a position because of an illiquid secondary market.

FLEX Options Risk. The Fund bears the risk that the Options Clearing Corporation (OCC) will be unable or unwilling to perform its obligations under the FLEX Options contracts. Additionally, FLEX Options may be less liquid. Furthermore, the values of FLEX Options do not increase or decrease at the same rate as the Index, which may cause the Fund’s NAV to fluctuate.

Please see the prospectus for more information regarding these and other risks associated with the Fund.

© 2024 Vest Group Inc. All rights reserved.

Vest Trademarks & Copyrights

Vest Financial LLC is an investment advisory firm registered with the U.S. Securities and Exchange Commission (SEC). Registration does not imply a certain level of skill or training. Vest Financial LLC is a wholly owned subsidiary of Vest Group Inc. Vest offers institutional-quality Target Outcome Investments(R) built on the backbone of its unique investment philosophy—that strive to buffer losses, amplify gains or provide consistent income — to a diverse spectrum of investors.