Important Disclosures, Please Read

Investors should consider the investment

objectives, potential risks, management fees and charges and expenses carefully before

investing. This and other information is contained in the Fund’s prospectus, which may

be obtained online, or by calling 855-505-VEST (8378). Please read the prospectus

carefully before investing. Distributed by Foreside Fund Services, LLC, Portland, ME.

Member FINRA/SIPC.

View this firm's background on

FINRA's BrokerCheck.

On January 2, 2024, the Fund’s name changed from Cboe Vest Bitcoin Strategy Managed Volatility Fund to Vest Bitcoin Strategy Managed Volatility Fund. This is a change in name only; the Fund’s objective and principal investment strategy remain the same.

Any comments or statements made herein do not reflect the views of Vest Group Inc. or any of their subsidiaries or affiliates.

The Fund will not directly invest in Bitcoin or any other digital currency. Bitcoin futures contracts involve the risk of mispricing or improper valuation and changes in the value of a futures contract may not correlate perfectly with price of Bitcoin.

An investment in the Fund involves a substantial degree of risk. Investors in the Fund should be willing to accept a high degree of volatility in the price of the Fund's shares and the possibility of significant losses.

The trademarks and service marks appearing herein are the property of their respective owners.

The Schwab name and Schwab logo are the trademarks of Charles Schwab & Co., Inc.

Interactive Brokers® is a trademark of Interactive Brokers, LLC

Risk Factors

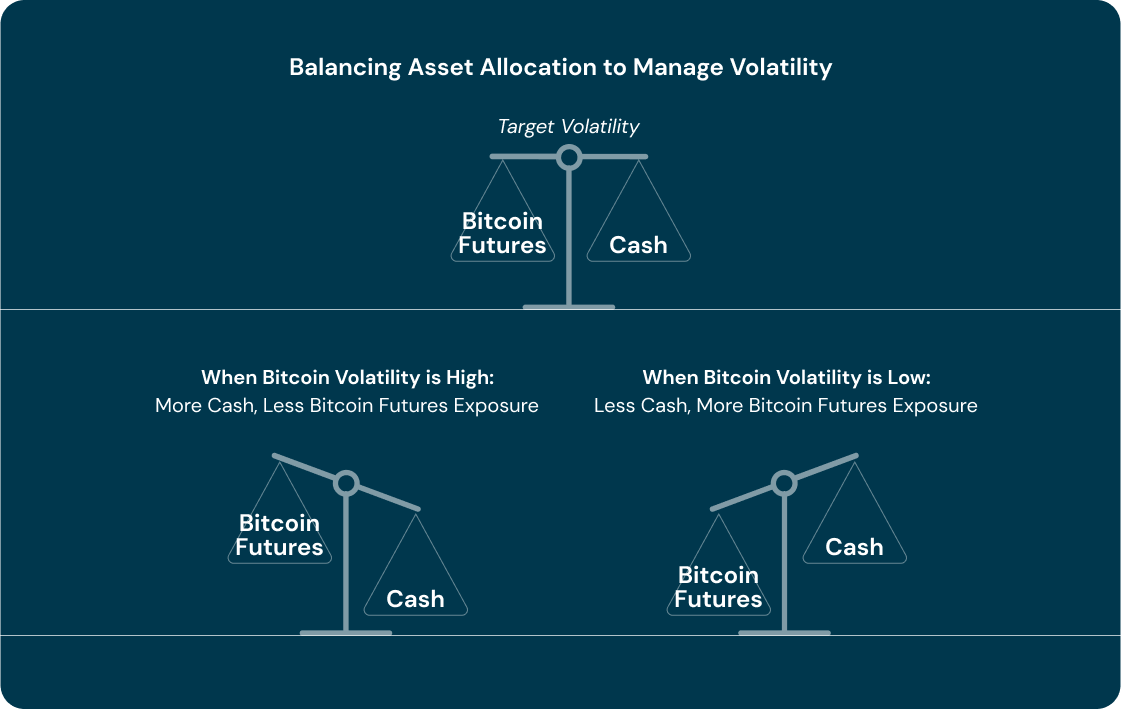

The Fund is a new fund and does not have a full calendar year of performance history. The Fund will invest in exchange-traded Bitcoin futures contracts that can be highly volatile. Using futures can increase the volatility of the Fund’s net asset value (“NAV”) and/or lower total return. A liquid secondary market may not always exist for the Fund’s futures contract positions at any time. The Fund may experience high portfolio turnover which may result in higher taxes when held in a taxable account. The market for exchange-traded Bitcoin futures contracts has limited trading history and operational experience and may be riskier, less liquid, more volatile and more vulnerable to economic, market and industry changes than more established futures markets, thus impacting the performance and risk profile of the Fund. The NAV of the Fund over short-term periods may be more volatile than other investment options because of the Fund’s significant use of financial instruments that have a leveraging effect. Due to the Fund’s investment strategy of limiting its volatility, the Fund’s actual investment in Bitcoin Futures may be a small portion of the Fund’s overall assets.

The primary underlying asset of the future contracts is Bitcoin, which has several risks that could impact Bitcoin Futures and the Fund. These risks, which could impact the price and value of Bitcoin, are: frequent or significant price movements; high levels of speculation; uncertainty as to growth in usage and in blockchain; an unregulated and uncertain regulatory environment; excess supply; instability and/or closure and shutdown of trading platforms for trading Bitcoin; the emergence of alternative digital assets and increased competition; reduction in supply; and increasing transaction fees. Together, the risks may result in changes in the confidence of investors. The prospectus provides complete details concerning risks of Bitcoin, the Fund, and investing in futures.

Futures contracts with a longer term to expiration may be priced higher than futures contracts with a shorter term to expiration, a relationship called “contango.” When rolling futures contracts that are in contango, the Fund may sell the expiring contract at a lower price and buy a longer-dated contract at a higher price, resulting in a negative roll yield. Conversely, futures contracts with a longer term to expiration may be priced lower than futures contracts with a shorter term to expiration, a relationship called “backwardation.” When rolling futures contracts that are in backwardation, the Fund may sell the expiring contract at a higher price and buy a longer-dated contract at a lower price, resulting in a positive roll yield. Due to contango, backwardation or other factors, the returns from Bitcoin Futures may differ from returns from a direct investment in Bitcoin, and an extended period of contango or backwardation may cause significant and sustained losses.

Please see the prospectus for more information regarding these and other risks associated with the Fund.